Tick Sizes and Values in ES, NQ, and RTY

Tick Sizes and Values in ES, NQ, and RTY – Why New Traders May Find More Success with RTY

In the world of futures trading, there are many factors to consider. Today, we will delve into the realm of tick size and tick value. We’ll be focusing on three of the most popular equity index futures: The E-mini S&P 500 (ES), The E-mini NASDAQ-100 (NQ), and the E-mini Russell 2000 (RTY).

Tick Size and Values Explained

Before we begin, let’s define tick size and tick values for our new traders. A tick is the smallest price increment a specific futures contract can move. Each futures contract has its designated tick size set by the exchange.

The tick value, on the other hand, is the monetary value assigned to each tick movement, whether up or down. So, the tick value represents the profit or loss that a trader will realize from each minimum price fluctuation.

ES, NQ, and RTY: Tick Sizes and Values

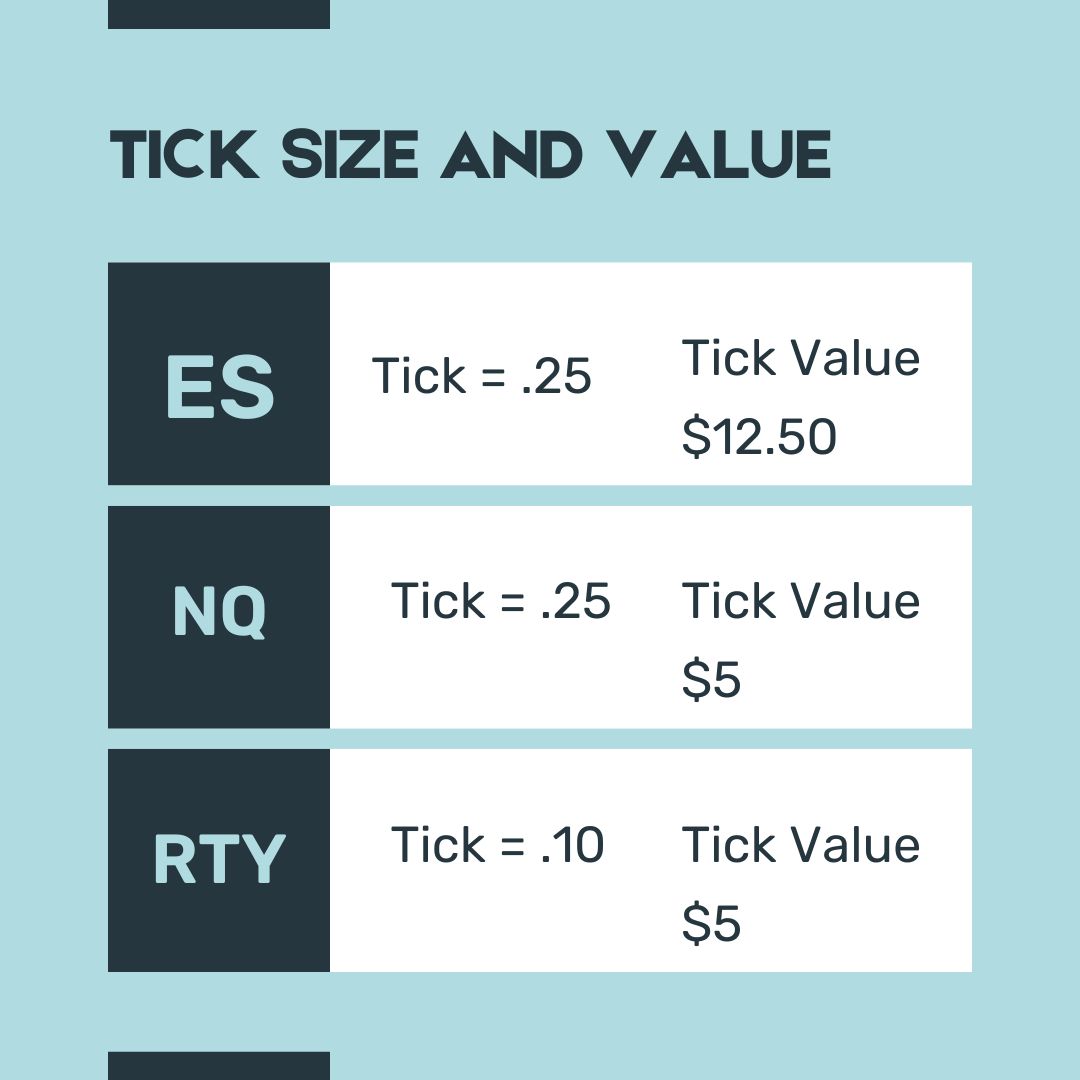

- E-mini S&P 500 (ES): ES futures contract has a tick size of 0.25 and a tick value of $12.50. That means the minimum price movement up or down is in increments of 0.25, and for each of these ticks, you gain or lose $12.50.

- E-mini NASDAQ-100 (NQ): NQ futures also have a tick size of 0.25, and their tick value is $5. So, like the ES, the smallest price movement is 0.25, but each tick represents a $5 gain or loss.

- E-mini Russell 2000 (RTY): For the RTY futures, the tick size is 0.10, and the tick value is $5. This implies that the RTY moves in smaller increments of 0.10, and for each tick, traders gain or lose $5.

Why New Traders Might Find More Success with RTY

As a new trader, starting with the RTY futures might give you an edge, and here’s why:

- Granular Price Movements: With a smaller tick size of 0.10, the RTY provides more granularity. This means that price movements are more gradual and less jerky, which can be more manageable for beginners still finding their feet in the futures market.

- Smaller Monetary Risk per Trade: Even though the tick value of RTY is the same as the NQ, the smaller tick size means that a new trader is risking less money on each individual trade. This can be beneficial for new traders who are still learning and wish to limit their financial exposure.

- Greater Flexibility: The smaller tick size in the RTY also allows for more precise trading. It provides traders with the ability to make more nuanced decisions and manage their trades more efficiently.

- Less Volatility: Compared to the ES and NQ, the RTY typically experiences less drastic price movements. This lower volatility can make it a safer option for new traders.

Smaller Account Size and Beginners Should Look to Micros

For traders who are just beginning their journey or those with a smaller account size, Micro E-mini futures contracts such as the Micro E-mini S&P 500 (MES), Micro E-mini NASDAQ-100 (MNQ), and Micro E-mini Russell 2000 (M2K) offer a more accessible entry point into the futures market. Each of these contracts is one-tenth the size of their respective E-mini counterparts, which significantly reduces the capital requirement for each trade.

The tick size and value also scale down by a factor of ten, making these micro contracts an excellent tool for practicing trading strategies or fine-tuning existing ones. Furthermore, they offer a way to gain exposure to major market indices with lower risk and capital outlay, making them ideal for new traders or those looking to diversify their portfolios. However, like all forms of trading, micro futures contracts also carry risks and it’s crucial for traders to understand these risks before beginning to trade.

The tick size and value also scale down by a factor of ten, making these micro contracts an excellent tool for practicing trading strategies or fine-tuning existing ones. Furthermore, they offer a way to gain exposure to major market indices with lower risk and capital outlay, making them ideal for new traders or those looking to diversify their portfolios. However, like all forms of trading, micro futures contracts also carry risks and it’s crucial for traders to understand these risks before beginning to trade.

Choosing the Right Contracts for Your Account Size

Just like an aspiring Options Trader should trade SPY before they attempt SPX, for traders working with prop firms and managing accounts of $50K and under, we highly recommend considering Micro E-mini futures contracts such as the Micro E-mini S&P 500 (MES), Micro E-mini NASDAQ-100 (MNQ), and Micro E-mini Russell 2000 (M2K).

These micro contracts offer lower margin requirements and risk, making them well-suited for smaller account sizes. They enable you to practice risk management strategies while still being exposed to major market indices.

On the other hand, for accounts of $75K and over, the E-mini contracts like ES, NQ, and RTY may be more appropriate. They offer greater dollar value per tick, potentially leading to higher profit, albeit with increased risk.

By selecting the contract size that best fits your account size and risk tolerance, you can effectively manage your capital and enhance your trading strategy. As always, understand the potential risks and consult with your prop firm or a financial advisor to determine the best course of action for your specific situation.

What We’ve Learned

Understanding the different features and benefits of Micro E-minis and E-minis, is essential for your success as a trader. If you are in the process of passing a prop firms trading challenge or trading with smaller account sizes, say $50K or less, Micro E-mini futures like the MES, MNQ, and M2K offer a fantastic opportunity. Their smaller tick sizes and values significantly lower the capital requirements, making it easier to manage risk while still being exposed to major market indices.

Moreover, for new traders or those wanting to experience less volatile market conditions, the E-mini Russell 2000 (RTY) can be a perfect fit. With its smaller tick size of .10 and less drastic price swings, the RTY provides a more manageable and less risky landscape, which can be vital for passing a prop firm’s challenge and getting funded.

To reiterate, futures trading comes with inherent risks. However, by choosing the appropriate futures contract—Micro E-minis for smaller accounts and the RTY for less volatility—you set yourself up for a potentially more successful trading journey. As always, tailor your trading strategies to fit your financial situation, risk tolerance, and specific trading objectives, and you’ll be on your way to becoming a successful, funded trader.

Your Next Step

We encourage you to take the next step in your trading career.

Check out our comprehensive prop firm quick guide to better understand how they operate and the unique opportunities they provide. Ready to take on a challenge? Sign up for a challenge account today and start your path towards becoming a funded trader.

We appreciate your support for our site. When you use our affiliate links to sign up for a prop firm or other services, you’re not only investing in your trading future but also helping us continue providing valuable content. Your support helps us keep the lights on and continue our work. So, thank you!

It’s a big trading world out there, and we’re here to help you navigate it. As always, your financial situation, risk tolerance, and trading objectives should guide your trading decisions. Happy trading!

Quick Links to Hop Straight to Offers From Our Favorite Prop Trading Firms

Apex Trader Funding Bulenox TopStep Trader BlueSky

Take Profit Trader LESEUP TradeDay Earn2Trade